Tokenize Everything

How tokens create, move, and improve markets

Hi friends 👋,

Happy Monday!

Let me tell you, this week I went DEEP. So deep that all of my previous rabbitholes now look woefully shallow in comparison. Here is a rather incriminating screenshot of my phone’s screen time report:

That’s right. I was 4 minutes away from spending more time on OpenSea this week than on the Messages app. Kindly note that Discord is a mere 10 minutes behind. That means I spent equivalent time conversing with Discord strangers as I did with my friends and family. The highlight reel of my escapades includes: joining a PFP community on Solana, waking up at 4am for an Ethereum NFT drop, and entering an NFT raffle attended by 2.5M+ wallet addresses. Needless to say, next week’s article will not be lacking source material.

For this article, we’ll take a step back from NFTs. Today is all about tokens. Tokens are the atomic unit in cryptocurrency; indivisible building blocks upon which empires are built. Of course, NFTs are just one form of Web3 token, which is why this week we’re bringing it back to the fundamentals of Web3.

Let’s get to it 🚀

Tokenize Everything

How tokens create, move, and improve markets

I think five years ago if any of us were asked about tokens our minds would immediately think of classic children’s arcades like Chuck-E-Cheese or Dave & Busters. As a kid, you’d sit in quiet anticipation, watching your parents dig into their wallets for cash to exchange into arcade tokens. After the token machine eats up your $20 bill, golden coins rain down into the collection tray, denominating your fun for the next few hours.

Flash forward to present-day, and the word ‘token’ has picked up some serious baggage. Crypto has stretched our understanding of tokens in strange new ways. Tokens now bring to mind connotations of algorithmic trading and parabolic JPEG prices. This piece is far from a unifying theory for tokens, but we will define exactly what tokens are, why they are useful, and how Web3 tokens usher in a new paradigm for the digital economy. As A16Z’s Chris Dixon says:

If Web3 tokens really are expected to be the new websites, it’s important for us to conceptualize where they start and stop.

Lessons from the arcade

Picture your 10-year self at Chuck-E-Cheese. In your hands, you hold an entire night of fun and games; $20 worth of prized tokens. These tokens are your key to interacting with the dazzling world of lights and whirring machines around you. Without them, you have no interface for getting the skee balls to drop or the pinball to launch. The arcade encapsulates a world of fun, and the only way to engage is to perform the irreversible ritual of buying arcade tokens. Once converted to arcade-currency, your $20 of value ceases to be recognized by anywhere but the arcade. Your value is locked in.

Now imagine a present-day 16-year-old, one who spends their after-school time playing Fortnite on their console of choice. Fortnite has become far more than a player-versus-player battle-royale, it is actually today’s most engaging social platform for young males. Much like Instagram and Snapchat, it has in-built pathways for social posturing and self-expression. In Fortnite, users buy in-game skins. These are aesthetic changes to their character that provide no improvement to gameplay performance. Any user can boost their cool factor by exchanging real-world money for in-game ‘V-bucks’. V-bucks are the only way to buy skins, and much like arcade tokens, are a one-way ticket for your dollars. To buy skins you have to commit value to the Fortnite ecosystem.

Beyond the use case of fun and games, there are countless examples of tokenization all around us. Consider the purchase of bus tokens. Any owner of bus tokens decided to store value in a bus-native currency, likely because their use of public transportation is so frequent. Someone who travels between Canada and the United States might have both Canadian and American bills in their wallet. We are conditioned to these examples but they, too, are models for tokenization. You’ll need USD to interface with the United States economy, much like you need arcade tokens to interface with the Chuck-E-Cheese economy. We can see it’s actually quite common to store value in different tokens to operate in different ‘economies’. The logic is the same.

The fundamental idea of any token is to act as the base unit of exchange within a system. No matter if that system is a country, video game, or transportation system. Your decision to own a token is a choice to stow away value for its respective use case. We know that tokens can take on many forms and have different properties. There’s a reason after all you have more dollars than V-bucks. But why would someone have more Bitcoin than dollars? Only by understanding the properties of a token and its system can we begin to answer these questions.

The power of tokenization

A likely outcome of Web3 is that we start seeing tokens pop up in many different walks of life. Future real-estate transactions could be centered around the transfer of house tokens instead of deeds. You might even see your concert tickets move on-chain in the near future. There are tokens that claim to be all sorts of things. But frankly, tokens have a bad rep. When every application, influencer, and breed of dog has its own token everything can start to seem a little gratuitous. Our exposure to Web3 ecosystems is only increasing and so it becomes important to distinguish between the good and the bad.

We can start by understanding that the power of tokens isn’t simply in their presence. It’s not the existence of a token that creates value. Valuable tokens should create incentives and unlock opportunities for token-holders.

Aligning incentives and ownership feedback loops

A great analogy for how tokens create incentives comes from the world of stocks. Being a shareholder in Apple makes it all the more appealing to buy Apple products. Why? Because your ownership in Apple closes the loop on your consumption, and now, in some small way your new iPhone purchase will trickle dollars into your own pocket. Owning Apple stock has made you complicit in the growth of the company, and likely turned you into a loyal brand ally.

Incentives like these are best described as ownership feedback loops, and they are a force to be reckoned with. Token ownership can turn normal users into fierce supporters, creating a much-needed moat in the red sea of competitive business. Ethereum seeded its own success by making its core developers rich, as they can now work full time on increasing the value of the Ethereum network, and by extension, their token holdings. NFT communities attempt to do the same for their token-holders, as do companies in the form of stock-based compensation. Tokens that impart ownership generate a mild form of tribalism that aligns user incentives with those of the system.

Ownership feedback loops are even changing the way that companies raise money. Many food and CPG startups are now looking to fundraise from their customers on platforms like Republic. They’ve learned the power of issuing ‘stock tokens’ to their customer base. Having more dollars isn’t correlated with patriotism because dollars don’t close the ownership loop for holders. You don’t ‘own’ more of the US economy if you have a large bank account. Stocks are the recognized token for growing in value and rewarding holders with dividends.

The making of micro-markets

It’s appropriate to think of tokens as an embodiment of a very small market. When a token is created it becomes the atomic unit of transactions for a small part of the economy. So tokens will be useful if they can make engaging in markets easier and more efficient.

Web3 tokens tend to have much fewer outlets for realizing their value. Arweave tokens can be traded for permanent data storage on the Arweave network. Axie Infinity NFTs are an entry pass for playing the Axie Infinity game. Even Ether can only be used to purchase a series of operations and data stores performed by Ethereum nodes. Instead of storing general optionality, Web3 tokens are used to represent incredibly specific optionality.

This makes it much easier for market participants to understand and find the right value exchange for their needs. The result is more efficient markets. Everyone on the Arweave network is either looking for storage or looking to sell storage. As a result, Arweave can offer an incredibly precise value prop. Tokens help create more clarity and transparency around purchasing decisions and trade.

Consider the fogginess surrounding some of your recent purchasing decisions. There is something innately difficult about financial planning, and it has to do with the imprecise nature of money. Money is really just a token that is generalized to the extreme. It embodies the ability to trade for anything, so your incentive to acquire it is really as a store of future optionality. But sometimes this optionality is so generalized that it leads to inefficient market behavior (i.e. over or under-thinking our purchasing decisions).

Does this mean we should ‘unbundle’ the money token? I’m not sure. The need for a generalized currency will always be present, but certain corners of our economy could benefit from market specificity. It’s possible that trusted tokens with precise value propositions can become a de facto way to engage in certain types of trade.

One token to rule them all

The main reason Web3 is so disruptive is it’s the first time tokens have ever been natively programmable. This lets us design more complex systems with unbounded creativity. The DAI stablecoin has created an incentive structure around their token which keeps it pegged to $1 USD. Most stablecoins remain ‘stable’ by backing their on-chain assets with cash equivalents. This poses a centralization risk, a very real one as we’ve seen with the recent Tether investigation. The innovation of DAI is that a program (smart contract) can create profit-earning incentives for token holders to keep the value as close to $1 as possible. This is only possible with a token that lives natively on the blockchain.

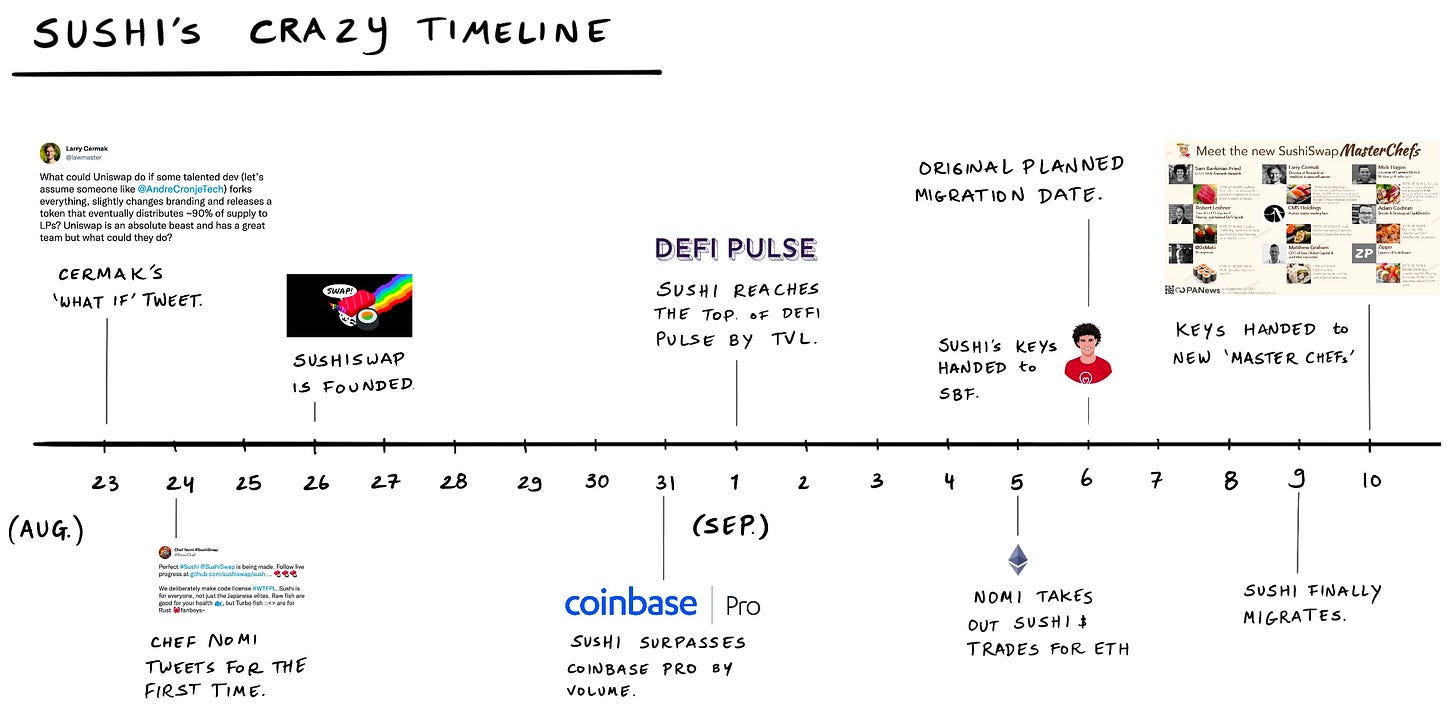

Web3 ushers in a world where tokens and applications with the best incentives win. A prime example is the infamous Sushiswap takeover. In the world of DeFi, users group their tokens together in ‘liquidity pools’ to make it easier for the ecosystem to swap token pairs (i.e. BTC for ETH). There is a small fee for token swapping and liquidity providers are rewarded with a proportionate fraction of the financial return. These transactions take place on decentralized exchanges, of which the most popular used to be Uniswap. Used to be? That’s right. In August of 2020, a pseudonymous developer repurposed Uniswap’s code (which was open source) with a mildly tweaked incentive system, donning the name Sushiswap. The result?

Token holders immediately picked up on the subtle change in the winds. It took only 7 days for Sushiswap to steal Uniswap’s hundreds of millions of dollars of liquidity. Markets move fast when token features can be reprogrammed and tweaked overnight. It has never been more lucrative to offer users a winning incentive combination, nor riskier to be a sluggish incumbent.

Turing-complete tokens

The story of Web3 is really the story of increasing the available feature set for digital tokens. It’s one big experiment of adding, subtracting and remixing token features to see what works for different markets and communities. Every now and then an experiment takes off and kickstarts an entire tokenized industry: like DeFi, NFTs, and DAOs. Tokens and their incentive systems are now Turing-complete, offering entirely new ways for tokens to create opportunities for holders.

Airdropping engagement

A key feature of Web3 tokens is that their ownership can be permissionlessly indexed and verified. Anyone can now identify a wallet based on its holdings. This has huge implications. Imagine there was a certain NFT community or token stakeholder group you wanted to reach. You could verify all the wallets of the Bored Ape Yacht Club community and ‘drop’ a message in their wallet. In fact, you could send a message to Steph Curry right now by looking up the Ethereum address that owns his BAYC and minting your note to his wallet. This is known as ‘airdropping’ and it’s an entirely new form of community engagement used by DAO and NFT communities.

In my favorite new development in this branch reality, one of the most influential NFT Twitter accounts, Cozomo de’ Medici revealed themself to be none other than Snoop Dogg.

As a result, communities are airdropping NFTs and tokens into his wallet for the express purpose of hoping some of his shine rubs off on them. CrypToadz, an NFT project with a floor price of 7.9 Eth (currently $27,354.46 USD) bequeathed him with an honorary toad.

This is surely a whole new way for influencers, creators and brands, to interact with communities and vice versa.

Collaboration in the open

What’s more, is the open-source nature of Web3 tokens makes it easier than ever to add value to token ownership. The ecosystem around Fortnite V-bucks is made more valuable with every skin they release. Arcade tokens increase in worth with every new machine added to the establishment. Traditionally, it has always been one entity that is responsible for bringing value to the ecosystem. In Web3, anyone can add to the ecosystem by making applications that recognize token ownership.

I recently bought into the Grim Syndicate, an NFT community on Solana. One of the community members made a web app to create an ‘ID badge’ for your NFT’s character.

This spin-off on the original art is known as a ‘derivative’. It uses the original token to verify your identity and gift you with this fun and quirky extension of the art. This gives owning your token a slight boost in perceived value because you can simply do more with it. Programmable tokens enable communities to generate value from within, and even encourage outsiders to make valuable add-ons to the community for no other reason than fun and internet points.

Tokens of the future

What’s fascinating is that we are only at the beginning of this journey. We’ve only cracked the surface on what you can do with digital tokens. Let’s recap what we’ve learned so far:

Tokens are everywhere. They are any currency that acts as the unit of exchange within a system

The most valuable tokens will be those that create incentives and unlock opportunities for token-holders

Tokens capture incredibly specific optionality for a small corner of the economy, bringing clarity to market transactions

Innovation on tokens means innovation on incentive structures. Applications with the best incentives will win

Tokens are made more valuable by adding functionality to the ecosystem that surrounds token ownership

Tokens encourage communities to self-organize and generate value for the collective

In the future, our crypto wallets may behave more like passports to digital experiences than stores of wealth. Each day, blockchain developers are designing better incentive structures to help users achieve their goals. It’s an evolutionary petri dish of testing and experimentation, and this is but a small window within it. If I had to guess, in a year’s time we will be shocked by the creativity of new developments made on top of token ecosystems.

What a beautiful and exciting world to live in.

If you enjoyed this article consider subscribing for weekly content on the technology that will shape our future!

If you really enjoyed this article consider sharing it with an intellectually curious friend or family member!

Let me know what you thought about this piece on Twitter.

With gratitude, ✌️

Cooper